eDiscovery Daily Blog

Confidence in eDiscovery Business is Still Strong: eDiscovery Trends

The results are in from Rob Robinson’s Spring 2016 eDiscovery Business Confidence Survey, which he conducted last month and the results are published on his terrific Complex Discovery site. Are individuals working in the eDiscovery ecosystem still as confident in the business as they were in the first quarter? Let’s see.

This time, there were 76 total respondents to the survey, which is almost the same number of respondents as the first survey back in February. Here are some notable results:

- Providers Were Still the Majority Respondents, But Not as Much: Of the types of respondents, 47 out of 76 were either Software and/or Services Provider (39.5%) or Consultancy (22.4%) for a total of 61.9% of respondents as some sort of outsourced provider (down from 68.8% last time). Law firm respondents were actually the second most represented group with 23.7%.

- Even More Respondents Consider Business to Be Good: Over 60% (61.8%, to be exact) of respondents rated the current general business conditions for eDiscovery in their segment to be good, with only 3.9% rating business conditions as bad. Last time, those numbers were 58.8% and 10% respectively.

- Almost Everyone Expects eDiscovery Business to be as Good or Better Six Months From Now: Almost all respondents (97.3%) expect business conditions will be in their segment to be the same or better six months from now, with 57.9% of respondents expecting higher revenue six months from now and 51.3% of respondents expecting higher profits six months from now. Only the revenue percentage shows a slight drop from the last survey (that time, 60% of respondents expected higher revenue in six months).

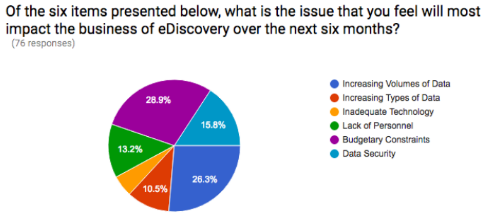

- Budgetary Constraints and Increasing Volumes of Data are Expected to be Most Impact eDiscovery Business: A couple of issues that you feel will most impact the business of eDiscovery over the next six months swapped rankings. Budgetary Constraints (28.9%) still led the way, this time closely followed by Increasing Volumes of Data (26.3%), with Data Security (15.8%) dropping to third, Lack of Personnel (13.2%), Increasing Types of Data (10.5%) and finally, Inadequate Technology (5.3%), rounding out the field. With recent stories such as the resolution of the Apple v FBI dispute (at least temporarily), the Verizon 2016 Data Breach Investigations Report and the “Panama Papers”, I was surprised that Data Security actually went down in the rankings. The graph below illustrates the distribution.

Rob has published the results on his site here, which shows responses to additional questions not referenced here. Check it out. It will be interesting to see how these numbers trend over time.

So, what do you think? What’s your state of confidence in the business of eDiscovery? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.