eDiscovery Best Practices: Cost of Data Storage is Declining – Or Is It?

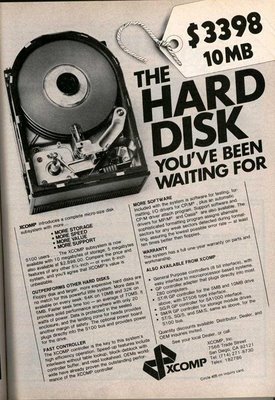

Recently, I was gathering information on the cost of data storage and ran across this ad from the early 1980s for a 10 MB disk drive – for $3,398! That’s MB (megabytes), not GB (gigabytes) or TB (terabytes). What a deal!

Even in 2000, storage costs were around $20 per GB, so an 8 GB drive would cost about $160.

Today, 1 TB is available for $100 or less. HP has a 2 TB external drive available at Best Buy for $140 (prices subject to change of course). That’s 7 cents per GB. Network storage drives are more expensive, but still available for around $100 per TB.

At these prices, it’s natural for online, accessible data in corporations to rise exponentially. It’s great to have more and more data readily available to you, until you are hit with litigation or regulatory requests. Then, you potentially have to go through all that data for discovery to determine what to preserve, collect, process, analyze, review and produce.

Here is what each additional GB can cost to review (based on typical industry averages):

- 1 GB = 20,000 documents (can vary widely, depending on file formats)

- Review attorneys typically average 60 documents reviewed per hour (for simple relevancy determinations)

- That equals an average of 333 review hours per GB (20,000 / 60)

- If you’re using contract reviewers at $50 per hour – each extra GB just cost you $16,650 to review (333×50)

That’s expensive storage! And, that doesn’t even take into consideration the costs to identify, preserve, collect, and process each additional GB.

Managing Storage Costs Effectively

One way to manage those costs is to limit the data retained in the first place through an effective records management program that calls for regular destruction of data not subject to a litigation hold. If you’re eliminating expired data on a regular basis, there is less data to go through the EDRM discovery “funnel” to production.

Sophisticated collection tools or first pass review tools (like FirstPass™, powered by Venio FPR™) can also help cull data for attorney review to reduce those costs, which is the most expensive component of eDiscovery.

So, what do you think? Do you track GB metrics for your eDiscovery cases? Please share any comments you might have or if you’d like to know more about a particular topic.