eDiscoveryDaily

Court Grants Lesser Sanctions Against Defendant for Various Discovery Issues: eDiscovery Case Law

In New Mexico Oncology v. Presbyterian Healthcare Servs. No. 1:12-cv-00526 MV/GBW (D.N.M. Aug. 16, 2017), New Mexico Magistrate Judge Gregory B. Wormuth, detailing numerous defendant discovery deficiencies alleged by the plaintiff, ruled that the “harsh sanctions of default judgment or an adverse jury instruction” requested by the plaintiff “are not warranted” and instead opted to require the defendant to pay plaintiff costs related to activities resulting from defendants’ over-designation of documents as privileged and recommended that the defendants be ordered to pay the plaintiff 75% of the costs associated with its Motion for Sanctions including all fees paid to expert witnesses to prepare reports and testify at the motion hearing.

Case Background

In this case, the plaintiff, detailing numerous alleged defendant discovery deficiencies, filed a Motion for Sanctions, requesting that the Court sanction the defendants by ordering default judgment against them, or, alternatively that the Court sanction the defendants by ordering an adverse jury instruction. The allegations included:

- Defendants failed to issue a proper litigation hold. The plaintiff alleged that the defendants’ original May 2012 litigation hold was inadequate because (1) it did not account for the “email jail,” a function which required that employees delete or archive emails when they run out of inbox space; (2) it covered only thirty-five employees and improperly excluded several key witnesses; (3) it allowed employees to determine which emails were irrelevant to the lawsuit and could be deleted; and (4) it did not apply to Defendants’ Live Exchange Server (a.k.a., the Transport Dumpster) and therefore did not preserve documents deleted by individual employees.

- Defendants intentionally deleted discoverable emails received or sent by Dr. Dava Gerard. The two primary pillars of the plaintiff’s case for intentional deletion were: (1) the data found within the “free space” of the Gerard PST file (the PST file was 2 GB in size, but only 128 MB of materials were readable by native software when opened), and (2) data was found in the unallocated space on the hard drive on which the Gerard PST file was saved.

- Defendants used privilege designations for the purpose of concealing documents and information. After the defendants produced their original privilege and redaction logs, the plaintiff objected to 2,831 of the 4,143 entries to which Defendants included in the logs. The defendants conducted a re-review and produced 1,095 documents which were originally listed on the privilege log and 864 documents which were originally listed on the redaction log. The plaintiff then objected to all 1,312 remaining listings on the privilege and redaction logs, stating that it no longer had confidence in Defendants’ privilege designations, leading to a second re-review, which led to an additional 861 documents produced. The plaintiff then filed a Motion to Compel and for Sanctions against Defendants, which included a request “that the Court appoint a Special Master to conduct an independent in camera review” of the remaining records withheld and redacted – that review led to 197 additional documents ordered to be produced.

The plaintiff also complained that the defendants failed to produce usable billing and claims data in a timely manner, produced ESI for the wrong custodian named Mike West and did not properly collect hard copy documents in discovery. As Frank Costanza would say at the Airing of Grievances during Festivus, “I got a lot of problems with you people”.

Judge’s Ruling

Judge Wormuth, reviewing the allegations in considerable detail, determined the following:

- Improper litigation hold: Judge Wormuth acknowledged that “Without question, Plaintiff points out some imperfections with the litigation hold and its implementation” and he detailed several of those. However, he also explained that “Plaintiff failed to establish that these imperfections were a result of bad faith or that they resulted in the spoliation of evidence.”

- Intentional deletion of emails: Noting that “the conclusion that data residing in the PST’s free space is only the result of deletion rests on the assumption that the export was conducted via the ‘client-side’ method, rather than the alternative ‘server-side’ method”, Judge Wormuth cited a lack of evidence that the collection specialist used a clean hard drive to conduct the collection and pointed to the presence of export logs to determine that the exports were conducted via the “server-side” method and concluded that “Plaintiff has not demonstrated by a preponderance of the evidence that Defendants intentionally deleted emails that should have been disclosed.”

- Privilege designations: Judge Wormuth agreed with the Special Master’s report that the defendants “did not act in bad faith”. But, he did state “this does not mean that Defendants are free from blame. It is clear that Defendants over-designated documents as privileged, and that even their re-reviews were insufficient to fix their own errors. As a result, Plaintiff was required to repeatedly assert objections until the Special Master ultimately resolved the issue.”

As for the other issues, Judge Wormuth ruled that the “Plaintiff can demonstrate no prejudice resulting from any such delays” in receiving the billing and claims data, that the “collection of documents from the wrong Mike West was an inadvertent error and not done in bad faith” and that, because of the plaintiff’s failure to request that the Court allow additional depositions of the employees associated with the hard copy documents, “more severe sanctions are not warranted”.

Ultimately, Judge Wormuth ruled that the “harsh sanctions of default judgment or an adverse jury instruction” requested by the plaintiff “are not warranted” and instead opted to require the defendant to pay plaintiff costs related to activities resulting from defendants’ over-designation of documents as privileged and recommended that the defendants be ordered to pay the plaintiff 75% of the costs associated with its Motion for Sanctions including all fees paid to expert witnesses to prepare reports and testify at the motion hearing.

So, what do you think? Was that an appropriate level of sanctions for the various discovery issues? Please share any comments you might have or if you’d like to know more about a particular topic.

Case opinion link courtesy of eDiscovery Assistant.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

Here’s a Factor That Can Reduce the Potential for Account Hacks: Cybersecurity Best Practices

The data breaches just keep coming. Equifax is the latest hacking victim to a tune of 143 million US customers – approximately 44 percent of the population. Perhaps if they, and other organizations recently breached, had added a factor to their authentication process, those breaches might not have occurred.

By “factor”, I mean two-factor authentication. Two-factor authentication, also known as 2FA, two step verification or TFA (as an acronym), is an extra layer of security that requires not only a password and username but also something that only that user has on them, such as a piece of information only they should know or have immediately available to them (such as a physical token). Using a username and password together with a piece of information that only the user knows makes it harder for potential intruders to gain access and hack into their system.

According to the latest Verizon Data Breach Investigations Report (DBIR) (covered by us here), 81 percent of hacking-related breaches used stolen passwords and/or weak passwords. Almost two-thirds of us use the same password for all applications that we access. And, with best practice recommendations for establishing secure passwords changing, it’s clear many people have been doing it wrong all these years and that just a password may not be enough to secure many accounts anymore.

This is where two-factor authentication can help, by offering an extra layer of protection, in addition to just the password. It would be highly difficult for most cyber criminals to get the second authentication factor unless they are very close to you or right there with you when you’re attempting to sign into the application. According to this infographic from Symantec, 80 percent of data breaches could have been eliminated with the use of two-factor authentication.

Probably the most common form of two-factor authentication is where the application sends you a code (via text or email – the means for sending may vary depending on the platform) once you provide your password that you have to enter to then be able to access the application. Unless a hacker can also access your email account or see your texts, that second layer of security helps protect against hacking of your account via just your password. Two-factor authentication is a terrific way to provide that extra layer of security and it’s important to consider whether your provider can support two-factor authentication when considering cloud providers (in general or when evaluating cloud eDiscovery platforms).

Also, if your organization has been affected by the recent hurricanes and you need the ability to access your data for a period of time while you rebuild, or to save costs in hosting for a case so that you can apply those savings to rebuilding your infrastructure, CloudNine can help. Click here to find out more and also how to help out those who were affected.

So, what do you think? Do your cloud providers support two-factor authentication? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

Thanks to ACEDS, Today’s the Day to Learn How Recent Case Law Has Affected Your eDiscovery Practices: eDiscovery Best Practices

The best predictor of future behavior is relevant past behavior. Nowhere is that more true than with legal precedents set by past case law decisions, especially when it relates to eDiscovery best practices. Are you aware of recent case law decisions related to eDiscovery best practices and what that those decisions mean to your organization? Thanks to our friends at ACEDS, you can learn a lot about those case law decisions today.

Today’s ACEDS webinar at noon CT (1pm ET, 10am PT) is titled Key eDiscovery Case Law Review for First Half of 2017. This one-hour webcast will cover key case law covered by the eDiscovery Daily blog related to eDiscovery for the first half of 2017, what the legal profession can learn from those rulings and whether any of the decisions run counter to expectations set by Federal and State rules for civil procedure. Topics include:

- How should objections to production requests be handled?

- Are you required to produce subpoenaed data stored internationally?

- Should there be a limit to fees assessed for discovery misconduct?

- When is data stored by a third party considered to be within your control?

- Should courts dictate search terms to parties?

- How can you make an effective proportionality argument to address burdensome requests?

- Can the requesting party dictate the form of production?

- Does storing data on a file share site waive privilege?

- If data is intentionally deleted, should Rule 37(e) apply?

- Is circumstantial evidence of intentional spoliation good enough to warrant sanctions?

- Should keyword search be performed before Technology-Assisted Review?

I’ll be presenting the webcast, Tom O’Connor, who is now a Special Consultant to CloudNine! To register for the webcast and get Tom’s and my unique takes on these cases, click here. Hope you can make it!

Also, if your organization has been affected by the recent hurricanes and you need the ability to access your data for a period of time while you rebuild, or to save costs in hosting for a case so that you can apply those savings to rebuilding your infrastructure, CloudNine can help. Click here to find out more and also how to help out those who were affected.

So, what do you think? Do you think case law regarding eDiscovery issues affects how you manage discovery? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

If You’ve Been Affected by the Recent Storms, CloudNine Wants to Help

Mother Nature has dealt this part of the world a tough couple of weeks. First, Hurricane Harvey hit the Gulf Coast, causing major damage and flooding in Houston and other areas. Then, this past weekend, Hurricane Irma has caused major damage in the Caribbean and in Florida and is continuing to wreak havoc to other parts of the country as we speak.

In Houston, our CloudNine family was very fortunate and blessed. None of our team members experienced any significant damage from Hurricane Harvey. Our platform continued to be available to our clients throughout the storm and its aftermath and our office remained up and running; though, because there was so much flooding throughout the city and driving was discouraged, most of our team members worked remotely throughout that week. Despite that, we were business as usual, providing software and services to our clients.

However, most (if not all) of our team members have family members or close friends who were affected – either by suffering damage in their homes and businesses or being evacuated (or both). Many of us at CloudNine, like many others in the Houston area and elsewhere, have helped to pitch in and help our neighbors recover.

As Craig Ball noted in his recent blog post regarding the disaster in Houston, the loss of property for law firms and other organizations extends to digital devices and media and potential loss of data on that media. When Hurricane Katrina hit New Orleans years ago, Tom O’Connor coordinated an effort to help firms in that area and others (such as Craig and Rob Robinson) assisted in that effort. Both Tom and Craig have discussed plans to undertake a similar effort to help those affected this time and I will certainly be happy to help in any way I can, including to help get the word out as more information is known about that effort.

Recovering the data is one challenge (and several organizations are offering to help there), recovering an organization’s IT infrastructure is another. Many firms will have to replace workstations, servers and networks. Doing so won’t be cheap and may not happen overnight. With that in mind, CloudNine is offering to host data for firms and organizations affected by the recent hurricanes for FREE for up to six months to enable those firms and organizations to be able to access that data while they rebuild. If your organization has been affected by these storms and you need the ability to access your data for a period of time while you rebuild, or to save costs in hosting for a case so that you can apply those savings to rebuilding your infrastructure, CloudNine can help.

To learn more, please contact us at salessupport@cloudnine.com and mention the FREE six month hosting offer.

And, if you’re interested in helping those affected by the hurricanes, here are a couple of resources to do that:

- Houston Texans football player J.J. Watt has established the Houston Flood Relief Fund for victims of Hurricane Harvey, which is (as of Monday morning) up over $31 million in donations. To donate, click here.

- Houston Mayor Sylvester Turner has also established the Hurricane Harvey Relief Fund, which accepts donations for flood relief victims. The organization will accept checks, money orders, bank wire transfers, stock, corporate bonds and other marketable securities. For donation instructions, click here.

- GlobalGiving’s Irma Relief Fund is accepting donations here. It vets the local organizations it helps fund and, according to The New York Times, is well-regarded by charity watchdogs.

Our thoughts and prayers are with all of those affected by the recent storms.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

Sometimes, the Data You Receive Isn’t Ready to Rock and Roll: eDiscovery Best Practices

Having just encountered a similar situation with one of my clients, I thought this was a topic worth revisiting. Just because data is produced to you, it doesn’t mean that data is ready to “rock and roll”.

Here’s a case in point: I once worked with a client that received a multi-part production from the other side (via another party involved in the litigation, per agreement between the parties) that included image files, OCR text files and metadata (yes, the dreaded “load file” production). The files that my client received were produced over several months to several other parties in the litigation. The production contained numerous emails, each of which (of course) included an email sent date. Can you guess which format the email sent date was provided in? Here are some choices (using today’s date and 1:00 PM as an example):

- 09/11/2017 13:00:00

- 9/11/2017 1:00 PM

- September 11, 2017 1:00 PM

- Sep-17-2017 1:00 PM

- 2013/09/11 13:00:00

The answer: all of them.

Because there were several productions to different parties with (apparently) different format agreements, my client didn’t have the option to request the data to be reproduced in a standard format. Not only that, the name of the produced metadata field wasn’t consistent between productions – in about 15 percent of the documents the producing party named the field email_date_sent, in the rest of them, it was simply named date_sent.

What a mess, right?

If you know how to fix this issue, then – congrats! – you can probably stop reading. Our client (both then and recently), didn’t know how. Fortunately, at CloudNine, there are plenty of computer “geeks” to address problems like this (including me).

In the example above, we had to standardize the format of the dates into one standard format in one field. We used a combination of SQL queries to get the data into one field and string commands and regular expressions to manipulate dates that didn’t fit a standard SQL date format by re-parsing them into a correct date format. For example, the date 2017/09/11 was reparsed into 09/11/2017.

Getting the dates into a standard format in a single field not only enabled us to load that data successfully into the CloudNine platform, it also enabled us to then identify (in combination with other standard email metadata fields) duplicates in the collection based on those metadata fields. As a result, we were able to exclude a significant percentage of the emails as duplicates, which wouldn’t have been possible before the data was converted and standardized.

Over the years, I’ve seen many examples where data (either from our side or the other side) needs to be converted. It happens more than you think. When that happens, it’s good to work with a solutions provider that has several “geeks” on their team that can provide that service. Sometimes, having data that’s ready to “rock and roll” takes some work.

So, what do you think? Have you received productions that needed conversion? If so, what did you do? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

The DOJ is the Latest to Learn that Redactions Aren’t as Straightforward as You Think: eDiscovery Best Practices

I keep thinking that all attorneys, especially those in large corporations, large law firms and federal agencies, understand best practices associated with performing redactions. Once again, I find that is evidently not the case.

According to Law360 (DOJ Redaction Flub May Undermine Libor Case, written by Jody Godoy, subscription required), U.S. Department of Justice lawyers made a potentially serious error in a Libor-rigging case against a former Deutsche Bank trader Wednesday when they mistakenly revealed the nature of testimony he was compelled to give to U.K. authorities in a separate probe.

According to the author, the DOJ partially redacted a motion to conceal the content of former Deutsche Bank trader Gavin Black’s testimony before the U.K. Financial Conduct Authority out of concern it could taint the DOJ’s Libor-rigging case against him. But the DOJ lawyers failed to properly excise the sensitive information until Law360 inquired about the faulty redactions last week.

The DOJ has since replaced the document — which was publicly available for more than 12 hours — with a properly redacted version, but the mistake had the potential to undermine their case against Black, especially in light of a July Second Circuit ruling in a similar Libor-rigging case, where they held that testimony compelled in the U.K. cannot be used in U.S. criminal cases and reversed two high-profile convictions. The reversal sent a strong warning to U.S. prosecutors working on cross-border cases.

The day the Second Circuit ruled in that case, Black notified U.S. District Judge Colleen McMahon that he would seek a “Kastigar” hearing in which the government would have to show that its case was developed independently from compelled interviews. The DOJ is fighting the request in large part on the basis that prosecutors on the case have been shielded from the material. The DOJ asked the judge on Aug. 25 for permission to file a response to Black’s hearing request under partial seal. One reason is that compelled testimony is treated as “confidential” under British law and that the FCA had requested it not be publicly filed. The attorneys at the DOJ’s criminal division who work separately from prosecutors on Black’s case also expressed concerns that a publicly filed document could expose the trial team or potential witnesses to the material.

Protecting the FCA testimony was crucial to the case against Black, particularly after the Second Circuit’s ruling reversing the convictions of Anthony Allen and Anthony Conti. The court found a witness may have been influenced by reading Allen’s and Conti’s statements, which were compelled under the threat of imprisonment. The Second Circuit said that fact undermined the case entirely, as the statements were not admissible at trial nor in a grand jury proceeding but had potentially tainted a witness who testified at both.

In the unredacted portions of the brief, the DOJ argued Black is not entitled to a hearing for several reasons. One of them was that the DOJ had taken great pains not to expose its prosecution team to inadmissible material, including asking that the U.K. prosecutors not share any compelled statements with the team as the two countries’ authorities pursued parallel investigations.

In the inadequately redacted portions of the brief, the prosecutors described the content of Black’s interview with the FCA. One sentence was highlighted in black and written in a gray font that was clearly legible. Other portions of the brief were blocked out with what appeared to be black highlighting but were easily read by copying and pasting the contents of the brief into another text document. Word searches of the document returned text that was barely hidden behind the faulty redactions.

A DOJ spokesperson attributed the exposure of the information to “a technical error in the electronic redaction process” that allowed for “manipulation” of the file’s “metadata.”

While I don’t know the specifics, it sounds like the DOJ experienced the first redaction “failure” that I described in this blog post here. Apparently, it still happens.

So, what do you think? Are you aware of any other recent redaction “fails” that have become public knowledge? (other than this one, of course). Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

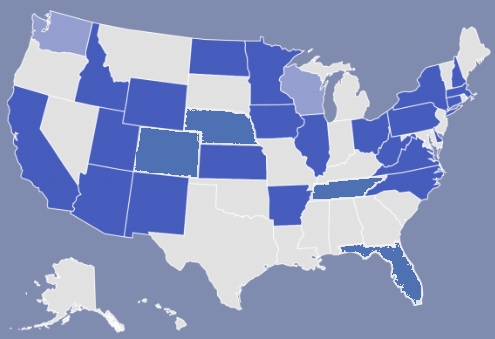

Nebraska is the Twenty Eighth State to Adopt Duty of Technology Competence: eDiscovery Trends

One of my favorite legal blogs is the LawSites blog by Bob Ambrogi. Bob is a prolific blogger who writes several posts a week, not only on his LawSites blog, but also on MediaLaw, and he co-authors Law.com’s Legal Blog Watch, and cohosts the weekly legal-affairs podcast Lawyer2Lawyer. And, he’s been doing it since 1993 (wow!). Bob has also been keeping track of states that have adopted a duty of technology competence and he just reported that Nebraska has become the twenty eighth state to do so.

According to Bob, the Nebraska Supreme Courtadopted the amendmenton June 28, 2017. It amends comment 6 to Nebraska Rule of Professional Conduct § 3-501.1 — the corollary to ABA Model Rule 1.1 on competence — to read as follows:

To maintain the requisite knowledge and skill, a lawyer should keep abreast of changes in the law and its practice, including the benefits and risks associated with relevant technology, engage in continuing study and education and comply with all continuing legal education requirements to which the lawyer is subject.

The italicized phrase is the same as the language that the ABA recommended in 2012 when it approved a change to the Model Rules of Professional Conduct to make clear that lawyers have a duty to be competent not only in the law and its practice, but also in technology.

While we’re up to 28 states, so far only two have apparently adopted a technology competence duty rule this year so far (Tennessee was the other state). This after six states adopted such a rule last year and seven adopted one in 2015. My rough graphic above has been updated to reflect the current states that have approved – still waiting for my home state of Texas to get with it. Nonetheless, we are making progress, slowly but surely. Thanks, Bob, for keeping track!

So, what do you think? Are you aware of any other states that have adopted a duty of technology competence or working towards adopting one? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

Here’s a Chance to Learn What You Need to Do When a Case is First Filed: eDiscovery Best Practices

The first days after a complaint is filed are critical to managing the eDiscovery requirements of the case efficiently and cost-effectively. With a scheduling order required within 120 days of the complaint and a Rule 26(f) “meet and confer” conference required at least 21 days before that, there’s a lot to do and a short time to do it. Where do you begin?

On Wednesday, September 27 at noon CST (1:00pm EST, 10:00am PST), CloudNine will conduct the webcast Holy ****, The Case is Filed! What Do I Do Now? (yes, that’s the actual title). In this one-hour webcast, we’ll take a look at the various issues to consider and decisions to be made to help you “get your ducks in a row” and successfully prepare for the Rule 26(f) “meet and confer” conference within the first 100 days after the case is filed. Topics include:

- What You Should Consider Doing before a Case is Even Filed

- Scoping the Discovery Effort

- Identifying Employees Likely to Have Potentially Responsive ESI

- Mapping Data within the Organization

- Timing and Execution of the Litigation Hold

- Handling of Inaccessible Data

- Guidelines for Interviewing Custodians

- Managing ESI Collection and Chain of Custody

- Search Considerations and Preparation

- Handling and Clawback of Privileged and Confidential Materials

- Determining Required Format(s) for Production

- Timing of Discovery Deliverables and Phased Discovery

- Identifying eDiscovery Liaison and 30(b)(6) Witnesses

- Available Resources and Checklists

I’ll be presenting the webcast, along with Tom O’Connor, who is now a Special Consultant to CloudNine! If you follow our blog, you’re undoubtedly familiar with Tom as a leading eDiscovery thought leader (who we’ve interviewed several times over the years) and I’m excited to have Tom as a participant in this webcast! To register for it, click here.

So, what do you think? When a case is filed, do you have your eDiscovery “ducks in a row”? Please share any comments you might have or if you’d like to know more about a particular topic.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.

Court Grants Defendant’s Request for $18.5 Million in Attorney Fees and Costs: eDiscovery Case Law

In Procaps S.A. v. Patheon Inc., 12-24356-CIV-GOODMAN, 2014 U.S. Dist. (S.D. Fla. Aug. 17, 2017), Florida District Judge Jonathan Goodman, in a very lengthy ruling, granted the defendant’s supplemental motion for attorney’s fees and non-taxable costs in the full amount requested of $18,494.846.

Case Background

In this case regarding an antitrust lawsuit filed by the plaintiff in which the defendant eventually won on summary judgment, the defendant filed a motion for costs and a motion for attorney’s fees and non-taxable costs. The Court eventually entered an order on the defendant’s bill of taxable costs, awarding it a judgment of $173,480.80 in taxable costs. After the plaintiff appealed, the Eleventh Circuit Court of Appeals affirmed the Court’s summary judgment ruling. In doing so, the Eleventh Circuit explained that “at bottom, this is essentially a breach of contract case — and so Procaps’s failure to support an antitrust theory is not all that surprising.”

The defendant then filed, under seal, (after extensive briefing, a multi-hour hearing and motion practice on other legal issues) a Supplemental Motion for Attorney’s Fees and non-taxable costs, explaining that the revised total amount sought is $18,494,846. In the defendant’s Supplemental Motion, while the defendant noted that it used higher hourly rates for fees incurred in 2016 and 2017 because its hourly rates increased over time, those rates still represented the 47.25% reduction off its primary law firm’s standard rates ordered by the Court.

Both parties agreed that the non-exhaustive list of discretionary factors that are considered when evaluating a Florida Deceptive and Unfair Trade Practices Act (FDUTPA) fee application was found in the case Humane Society of Broward County, Inc. v. Florida Humane Society, 951 So. 2d 966, 971-72 (Fla. 4th DCA 2007), which stated the factors as:

(1) the scope and history of the litigation; (2) the opposing party’s ability to satisfy the award; (3) whether an award would deter others from acting in similar circumstances; (4) the merits of the respective positions, including the degree of [Procaps’] culpability or bad faith; (5) whether the claim brought was not in subjective bad faith but was frivolous, unreasonable, or groundless; (6) whether the defense raised a defense mainly to frustrate or stall; and (7) whether the claim brought was to resolve a significant legal question under FDUTPA law.

Judge’s Ruling

Judge Goodman, in considering the first factor, noted that “Nothing was easy in this case. Nothing. Basically, the parties fought about anything and everything.” He also observed that “Procaps largely based its FDUTPA claim on its antitrust claim theory and sought both damages and attorney’s fees under this count…It continued to press despite the Court’s warning that it might be liable for all of Patheon’s fees under FDUTPA.” Judge Goodman, noting that “in December 2015, Patheon explained that Procaps’ market value was $238.9 million”, also ruled that the plaintiff “does have the ability to pay an $18.5 million judgment.”

Considering the plaintiff’s culpability or bad faith, Judge Goodman spent a lot of time on this issue, including time discussing alleged prior misconduct by the plaintiff’s lead counsel in another case. While he stated that “the Court is not going to consider the Surgery Centers case and similarly will not specifically consider the 16 bad faith factors (from this case) and the alleged appellate-level misconduct asserted by Patheon”, he also stated that the “facts underlying the 16 bad faith factors are, for the most part, true or substantially true (sic). They happened. The Court knows that they happened (or substantially happened) because of its involvement in this case for the past four-and-a-half years.”

Ultimately, Judge Goodman determined that all the factors necessary to grant the fee request were present and stated that “the Court notes that even Procaps admits that the antitrust theory inherent in its FDUTPA claim was dependent on the success it had with the federal Sherman Act antitrust claim. Therefore, those federal claims concerned allegations of deceptive and unfair trade practices, which means that Patheon, as the prevailing party, is entitled to fees and costs for the entire action.” As a result, Judge Goodman, determining that the defendant’s method for calculating the fees was proper, granted the defendant’s supplemental motion for attorney’s fees and non-taxable costs in the full amount requested of $18,494.846.

We’ve covered this case three other times previously – here are the three links to those previous rulings.

So, what do you think? Is that a reasonable award, given all of the plaintiff’s alleged misconduct over the course of the case? Please share any comments you might have or if you’d like to know more about a particular topic.

Case opinion link courtesy of eDiscovery Assistant.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.