It’s Time for Your Annual “Mashup” of eDiscovery Market Estimates!: eDiscovery Trends

The appearance of the mashed potato graphic can only mean one thing. Nope, not that it’s Thanksgiving week (though, many of us will enjoy our mashed potatoes this Thursday). It means that it’s time for the eDiscovery Market Size Mashup that Rob Robinson compiles and presents on his Complex Discovery site each year.

It’s become an annual tradition for Rob to release it earlier and earlier each year, and, this year, he released his worldwide eDiscovery services and software overview for 2019 to 2024 on November 12 (not quite before Halloween like I predicted last year, but still eight days earlier than last year, so it might happen next year). ;o)

This is the eighth(!) year we have covered the “mashup”(!) and we can continue to gauge how accurate those first predictions were. The first “mashup” covered estimates for 2012 to 2017 and the second one covered 2013 to 2018. Last year, we took a look how close the estimate was for 2018 back then. This year, we can look at the original 2019 with a look back at the estimates for 2014-2019 (in two parts). We’ve also covered estimates for 2015 to 2020, 2016 to 2021, 2017 to 2022 and 2018 to 2023 and will undoubtedly look at those in future years.

Taken from a combination of public market sizing estimations as shared in leading electronic discovery publications, posts, and discussions (sources listed on Complex Discovery), the following eDiscovery Market Size Mashup shares general market sizing estimates for the software and services area of the electronic discovery market for the years between 2019 and 2024.

Here are some highlights (based on the estimates from the compiled sources on Rob’s site):

- The eDiscovery Software and Services market is expected to grow an estimated 12.93% Compound Annual Growth Rate (CAGR) per year from 2019 to 2024 from $11.23 billion to $20.63 billion per year. Services will comprise approximately 69.7% of the market and software will comprise approximately 30.3% by 2024.

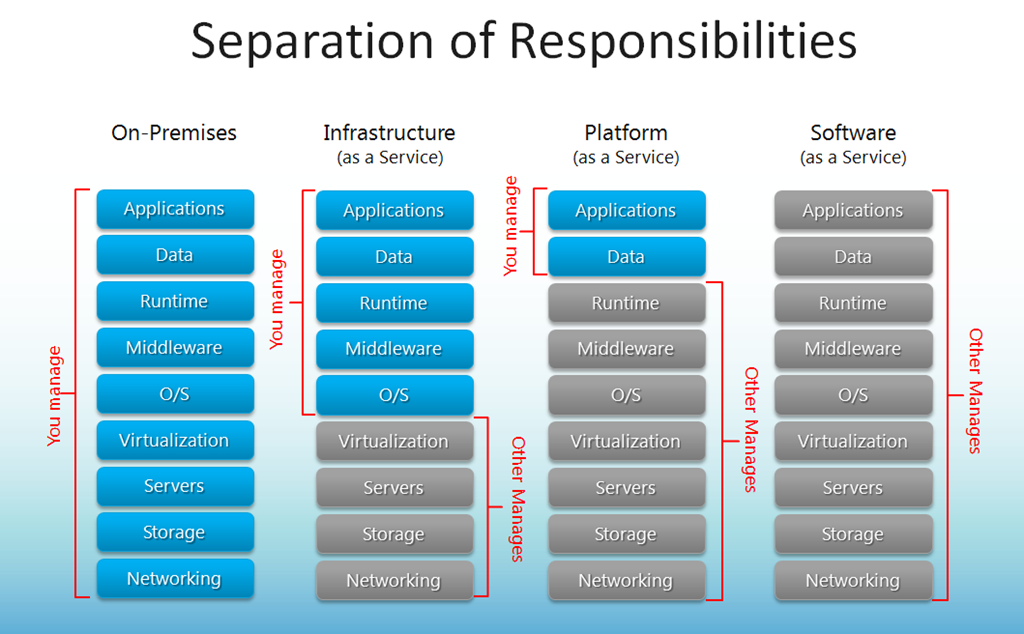

- The eDiscovery Software market is expected to grow at an estimated 13.05% CAGR per year from $3.39 billion in 2019 to $6.26 billion in 2024. In 2019, software comprises 30.2% of the market and, by 2024, approximately 64% of the eDiscovery software market is expected to be “off-premise” – a.k.a. cloud and other Software-as-a-Service (SaaS)/Platform-as-a-Service (PaaS)/Infrastructure-as-a-Service (IaaS) solutions.

- The eDiscovery Services market is expected to grow at an estimated 12.88% CAGR per year from 2019 to 2024 from $7.84 billion to $14.37 billion per year. The breakdown of the services market by 2024 is expected to be as follows: 63% review, 20% processing and 17% collection.

If we look at the original “mashup” that we covered for 2014-2019 (in two parts), the original eDiscovery Software and Services market estimate for 2019 was $10.56 billion, the original Software portion of the estimate was $3.38 billion and the original Services portion of the estimate was $7.18 billion. So, the original software estimate was understated at .01 billion, while the original services estimate was understated by .66 billion. Overall, that’s an understatement of .67 billion. A reversal from last year, where all of the 2018 estimates were overstated from the actual 2018 numbers reported last year.

A couple of other notable stats:

- The U.S. constitutes approximately 63% of worldwide eDiscovery software and services spending in 2019, with that number decreasing to approximately 58% by 2024.

- Off-Premise software spending constitutes approximately 54% of worldwide eDiscovery software spending in 2019, with that number increasing to approximately 64% by 2023. That’s a considerably slower move to off-premise than previously forecast five years ago (78% by 2019). So, on-premise software is still a significant portion of the software market and is expected to be for some time to come.

So, what do you think? Do any of these numbers surprise you? Please share any comments you might have or if you’d like to know more about a particular topic.

Sponsor: This blog is sponsored by CloudNine, which is a data and legal discovery technology company with proven expertise in simplifying and automating the discovery of data for audits, investigations, and litigation. Used by legal and business customers worldwide including more than 50 of the top 250 Am Law firms and many of the world’s leading corporations, CloudNine’s eDiscovery automation software and services help customers gain insight and intelligence on electronic data.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.