Editor’s Note: Tom O’Connor is a nationally known consultant, speaker, and writer in the field of computerized litigation support systems. He has also been a great addition to our webinar program, participating with me on several recent webinars. Tom also wrote a terrific four part informational overview on Europe’s General Data Protection Regulation (GDPR) titled eDiscovery and the GDPR: Ready or Not, Here it Comes (and participated with me on a webcast on the same topic) and wrote another terrific five part informational overview on Understanding eDiscovery in Criminal Cases. Now, Tom has written another terrific overview regarding Alternative Legal Service Providers titled ALSP – Not Just Your Daddy’s LPO that we’re happy to share on the eDiscovery Daily blog. Enjoy! – Doug

Tom’s overview is split into four parts, so we’ll cover each part separately. We covered part one on March 8 and parts two and three last Monday and Thursday. Here’s the final part, part four.

What does this mean for the future of ALSPs?

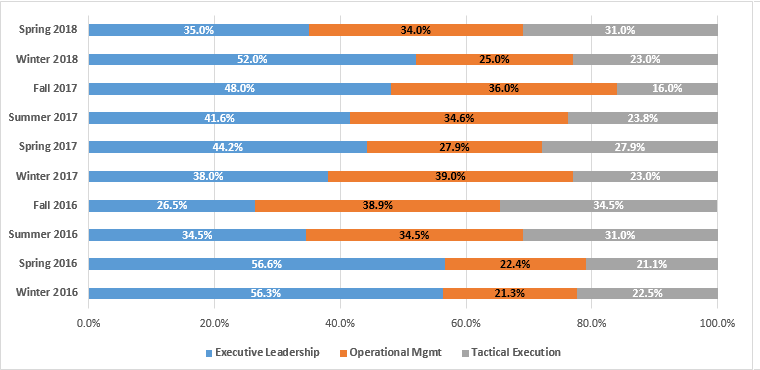

According to the Thomson Reuters report, ALSPs are likely to continue to expand as the complexity and specialization of legal services grows. Additionally, we can expect that even more areas of ALSP specialization will develop. Some of the AM Law 50 and Fortune 50 may still choose to keep their work in-house due to their high level of internal resource or pains endured in the past with ALSPs, but the overall market for ALSP services in the rest of the legal profession should continue to expand.

Specifically, the report showed that while only 38 percent of law firms use a litigation support ALSP now, another 15 percent said they would be likely to use them in the next year. And among regulatory risk and compliance services for corporations, the number of users increases 13 percent for new users within the next year.

The biggest driver? Technology. Firms and companies interviewed for the report identified a number of different technologies they hoped ALSPs would use in the near future, including:

- artificial intelligence,

- contract management,

- process mapping, and

- workflow technology.

Eric Laughlin, Managing Director of Legal Services at Thomson Reuters, noted that in many cases, these are technologies that are still in the nascent stages in firms or legal departments, saying:

“I think it shows that while legal departments and law firms either haven’t been able to adopt yet because of budget, or perhaps because of the scale, they have high expectations that ALSPs will use technology to their advantage.”

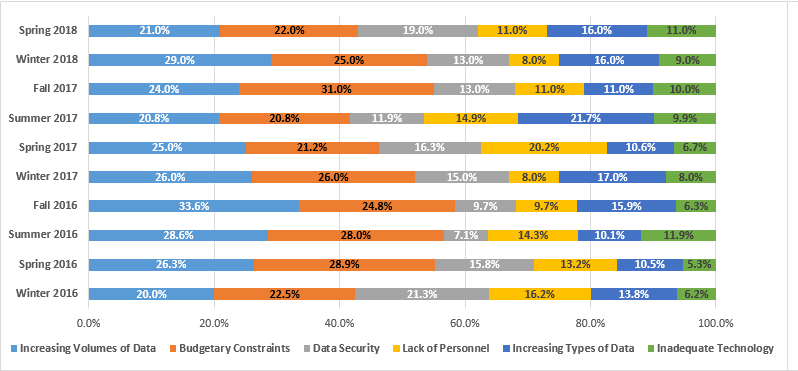

Will there be growth pains? Undoubtedly. The Thomson Reuters report mentions several areas that law firms and corporations would like clarified before adopting ALSPs, including:

- 59 percent of law firms that do not use ALSPs cited data security as the main reason,

- 54 percent of law firms cited quality of service as an inhibitor,

- 43 percent of corporate users also cited quality of service as a negative, and

- 43 percent of corporate users cited failure to actually reduce costs as the most negative factor.

The Legaltech New York panel mentioned earlier highlighted these factors, with security getting the most attention. However, the panel suggested these issues may revolve mainly around market education and getting potential customers more familiar with and gaining experience using ALSPs, rather than being insurmountable barriers to continued growth.

The panel also discussed the potential growth in the ALSP market and opined that ALSPs may be viewed as complementary, rather than competitive to firms, helping firms be more efficient and competitive. Since an ALSP is not a law firm, it can often provide one or more services that law firms might offer, but at a lower cost with increased expertise, flexibility, and speed.

Also, because they do not have to adhere to the structure and hierarchy of a law firm, an ALSP can more quickly change business practices to increase efficiency using technology or other innovative practices. Since clients have traditionally preferred having a single point of contact for all their legal business, this would seem to open the door to the opportunity for the law firm or GC to partner with ALSPs to offer cost-effective models for their clients.

What will that future ALSP included hierarchy look like? First and foremost, it will require good project management skills. Well known legal consultant Casey Flaherty, Principal of the legal operations consulting company Procertas, was recently quoted as saying:

“Most successful users of ALSPs will tell you that… once they took time to train the provider and work to establish a common understanding for the product, the returns on the investment were spectacular.”

So more and more, ALSPs will become partners in legal work more than merely hired vendors. And like all partners in the legal process, the relationship will be ongoing and not simply oriented around one deliverable task.

“The future is now,” Fenwick & West LLP’s Robert Brownstone, who led the Legaltech panel on ALSPs, tells any and everyone who will listen. Brownstone often points out that “it is the rare law firm or legal department that can adequately ramp up – and keep up – on technology, project management and innovation. By planting their flag, ALSPs have provided legal departments not only with a wider array of choices but also a lever to pressure law firms to adjust to the new normal.”

So, while the future appears to be bright for ALSPs, the future also appears to be now.

So, what do you think? Have you used an ALSP before? And, as always, please share any comments you might have or if you’d like to know more about a particular topic.

Also, it’s notable that Tom’s post is today because I (Doug) want to thank JD Supra and its readership for CloudNine being named the Readers’ Choice Top Firm in eDiscovery for the second straight year! And, Tom and I were named two of the top four authors in the Readers’ Choice awards for eDiscovery! I’m honored to be named for the second year in a row! Distribution of our posts via JD Supra has continued to grow our readership greatly and I really appreciate our partnership with JD Supra and thank all of you for reading our blog, whether it’s via JD Supra or the “old fashioned way” via our site! Thank you so much!

And, today our blog has been around for 7 1/2 years! And, we are up to 1,942 lifetime posts! Thanks to all of you of support and readership of the blog and making it all possible. We wouldn’t write it if y’all didn’t read it! :o)

Sponsor: This blog is sponsored by CloudNine, which is a data and legal discovery technology company with proven expertise in simplifying and automating the discovery of data for audits, investigations, and litigation. Used by legal and business customers worldwide including more than 50 of the top 250 Am Law firms and many of the world’s leading corporations, CloudNine’s eDiscovery automation software and services help customers gain insight and intelligence on electronic data.

Disclaimer: The views represented herein are exclusively the views of the author, and do not necessarily represent the views held by CloudNine. eDiscovery Daily is made available by CloudNine solely for educational purposes to provide general information about general eDiscovery principles and not to provide specific legal advice applicable to any particular circumstance. eDiscovery Daily should not be used as a substitute for competent legal advice from a lawyer you have retained and who has agreed to represent you.