Managing the Unpredictability of eDiscovery Costs

Client fees are the lifeblood of the legal industry which means unpredictability isn’t congruent to the financial stability of a successful law firm. This means your eDiscovery document review solution can be as much of a liability as it is an asset when striving to remain profitable.

As every case differs in the volume and type of data collected, processed, and reviewed, the costs associated with it can be unpredictable. Without a balanced and consistent cost structure, the result can lead to an undesirable profit loss.

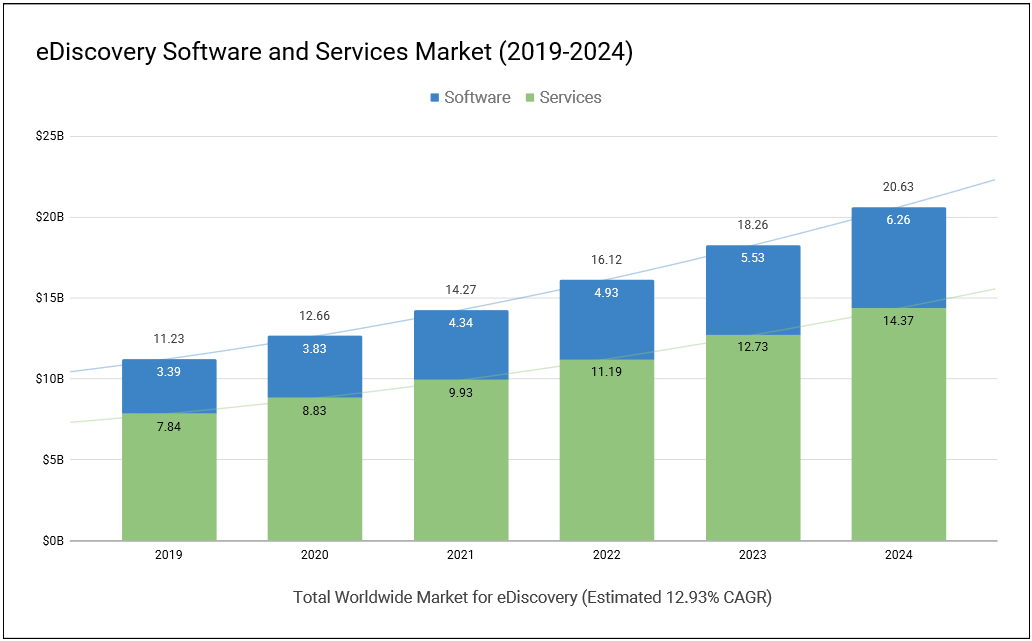

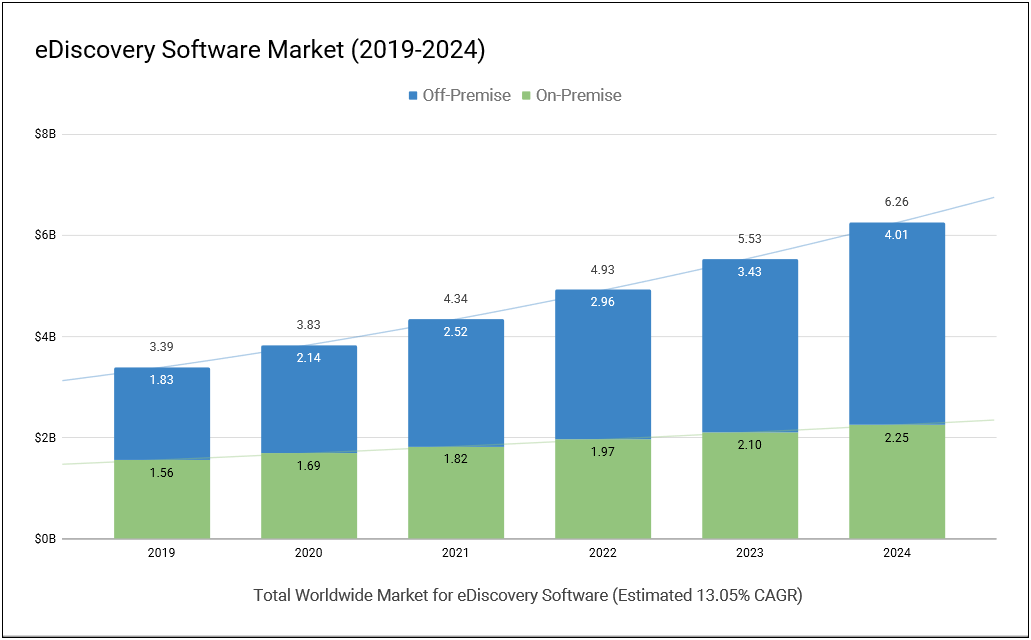

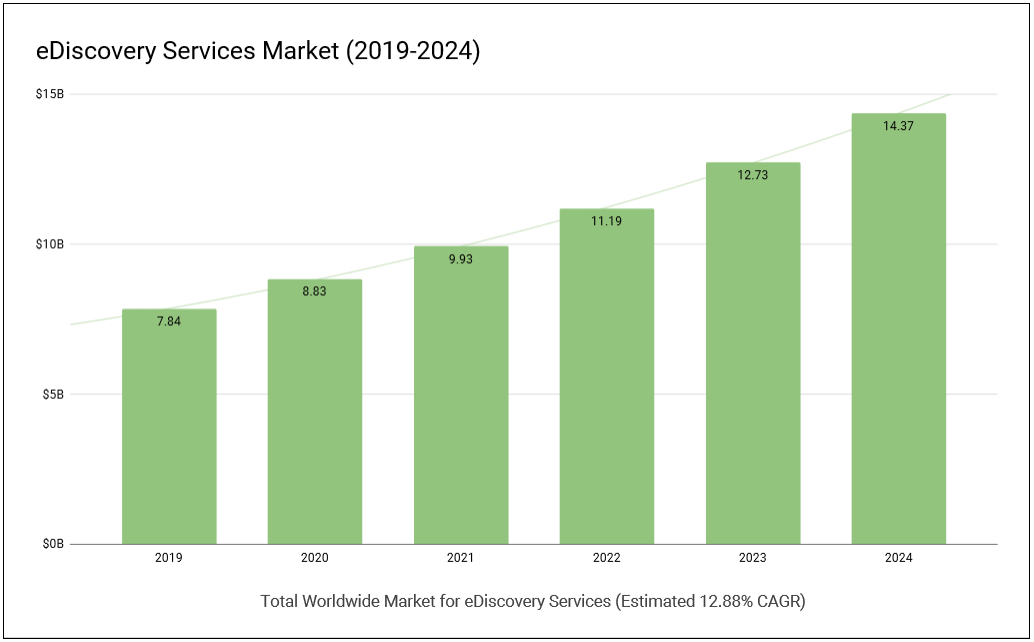

When eDiscovery was first utilized in the late 1990s, it was only in special cases involving email correspondence. Today, the American Bar Association (ABA) estimates that eDiscovery accounts for more than 80% of costs. That translates roughly to $42 billion a year, with 70% of costs directly associated with document review.

Today’s eDiscovery has evolved further to include device data derived from multiple sources which can quickly inflate expenses and severely impact your operating budget.

At CloudNine , we are dedicated to guiding you towards eDiscovery cost recovery through our streamlined and optimized data solutions; read on for more of our tips to getting to the truth and your revenue goals more efficiently.

Get to The Truth Faster: The Biggest Challenges to Profitable eDiscovery

Controlling eDiscovery costs and charging your clients appropriately comes with certain challenges.

eDiscovery Insourcing vs Outsourcing: The profitability between these two options isn’t always black and white. There are a variety of factors when considering if outsourcing eDiscovery is the right choice for you, including:

- What pricing models do vendors offer?

- Are there additional fees?

- How do hosting costs change over time?

- Does the vendor own their technology or do they lease it?

- What’s the full extent of capabilities the vendor has to offer?

By understanding the hidden costs of outsourcing, you can determine if it will allow you to balance cost and functionality effectively.

Delays in Court Proceedings: According to an article in the Washington Post, district attorneys are facing some of the longest case backlogs in living memory due to the COVID-19 pandemic. These delays mean more costs for longer hosting and storage times for important eDiscovery data, especially when being billed by the gigabyte.

Unpredictable Timing: The Sixth Amendment to the U.S. Constitution guarantees a person accused of a crime the right to a speedy trial. That means by federal law, a criminal case must proceed to trial within 70 days of indictment. However, felony trials can sometimes linger for well over a year. The unpredictability of time between indictment and trial means costs can run higher than expected.

Managing Multiple Vendors and/or Systems: With many vendors specializing in different features and functions, it’s difficult to find a one-stop shop for all your eDiscovery solution needs. To compensate, you’ll need to engage with different vendors resulting in more contracts, more fees, and more time wasted learning how to operate the different systems.

By using a single solution to collect and assemble multiple modern data types, you can better retain the relevant context and timeline to tell the whole story. Putting together all the pieces of the puzzle becomes simpler, faster, and more strategic.

Making eDiscovery Costs More Predictable: A consistent cost recovery model can help predict and recuperate many eDiscovery expenses, but you’ll want to evaluate the pros and cons to identify the model best suited for your firm.

Examples of common cost recovery models include:

Billable Hours: The majority of law firms traditionally charge clients the billable hours they spend performing processing and project management. This model results in the least amount of pushback from clients as they’re paying strictly for the attorneys’ time. However, this can become less profitable if your law firm is forced to host its eDiscovery data long-term due to delays in court proceedings.

Billable Hours + Hosting Fees: To compensate for increased expenses, your law firm can add hosting fees to billing statements in addition to billable hours. However, clients often push back as they may not view hosting fees as actual legal work. These fees, usually charged per gigabyte, can help you recoup eDiscovery costs, but only if the client is willing to pay.

Third-Party Vendor Style: Another option for cost recovery is to invoice your clients with line items similar to how a third-party eDiscovery vendor would operate. You can include billing for individual items such as:

- The number of gigabytes processed

- The volume of data hosted

- Any analytics applied to the data

- Any licensing fees for software used

While some clients may be familiar with this model based on their experience with eDiscovery vendors, others may balk at these types of expenses. Learn more about how to optimize your eDiscovery cost recovery by downloading our eBook: Optimize eDiscovery Cost Recovery: 6 Steps to Make Your Review Process More Profitable.

Streamline with CloudNine. Optimize eDiscovery in Minutes.

As a proven leader in eDiscovery, CloudNine has provided innovative data collection and review solutions for hundreds of law firms and legal service providers since 2002.

Regardless of the type of cost recovery model you choose, CloudNine’s eDiscovery platform delivers a complete and flexible suite of solutions at a predictable and affordable price. Some of the benefits include:

- SaaS Hosting for All Data – CloudNine’s SaaS offering allows analysis and review of all modern data types to include email, text messages, corporate chat applications, and geolocation.

- Data and Storage Control – Right-size your data by culling it upfront to reduce your storage needs and control your costs.

- User-Friendly Solutions – Every CloudNine solution is easy to use and operates on a self-service basis including smartphone collection data.

- Dedicated Support – Our services teams are always available if you need additional support.

- Flexible Storage – Optimize your spending whether you choose our all-in storage option or choose to pay for storage as needed.

- Low Overall Pricing – Get predictability and affordability without compromise and leverage the features you need without paying for the ones you don’t.

Improve and optimize your eDiscovery by simplifying and streamlining the process. You’ll make it easier on your clients and more profitable for your firm. Reach out and book a demo to learn how CloudNine can make your eDiscovery most cost-efficient.